Granica for Financial Services Companies

Learn how Granica helps.

Over the last few years, AI technology has evolved and matured to be a powerful tool for financial services and fintech companies spanning a wide range of use cases including:

- Customer potential/wallet sizing

- Relationship manager productivity

- ESG/net-zero analytics

- Retention/churn analytics

- Personalized product recommendations

- Pricing optimization

- Sales and demand forecasting

- Spend analytics

- Granular liquidity and cash forecasting

The challenge

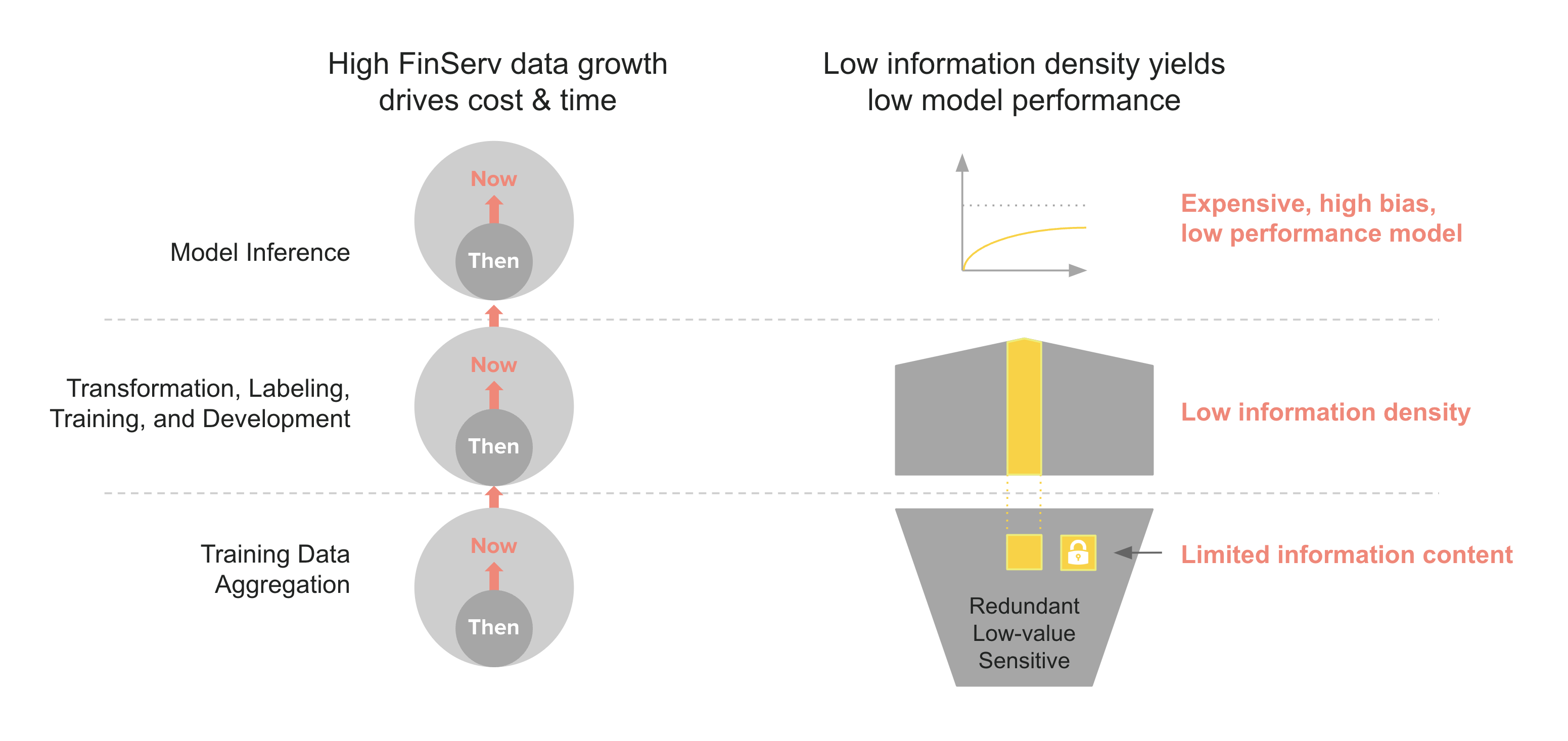

To achieve success with AI, financial services companies capture and aggregate data from a wide range of online, and even offline, sources or "sensors". The volume of online clickstream, traffic logs, database extracts, social and other data is tremendous and can easily grow to tens of petabytes, costing millions of dollars annually even when stored in "low-cost" cloud object stores. Data at this scale also puts a strain on the entire AI pipeline from both a cost and time perspective.

For financial services companies, all data is hot data which must be quickly ingested, analyzed, and acted upon in order to generate value. As a result, companies typically build their AI data infrastructure around leading cloud object storage offerings such as Amazon S3 Standard and GCS Standard rather than archival tiers such as Amazon S3 Glacier and GCS Archive. Archival tiers are not only slow and asynchronous, they also come with heavy read access and data transfer costs. Those same access costs also preclude usage of faster object storage tiers such as Amazon S3 Infrequent Access (IA) and GCS Nearline. While S3/GCS Standard tiers are thus the most cost-effective given the processing needs of AI, the volume of data means that storage-related costs are still large and growing rapidly.

Making matters worse, finanial services data typically contains significant redundant and low-value content. It also often contains sensitive content given the very nature of financial data, as well as the fact that clickstream data captures user behaviors and inputs. Such content works to reduce the "signal to noise" in the data, and also increases the resources cost and time to move it through the end-to-end pipeline. For example sensitive information impacts privacy and compliance and requires remediation before it impacts model development.

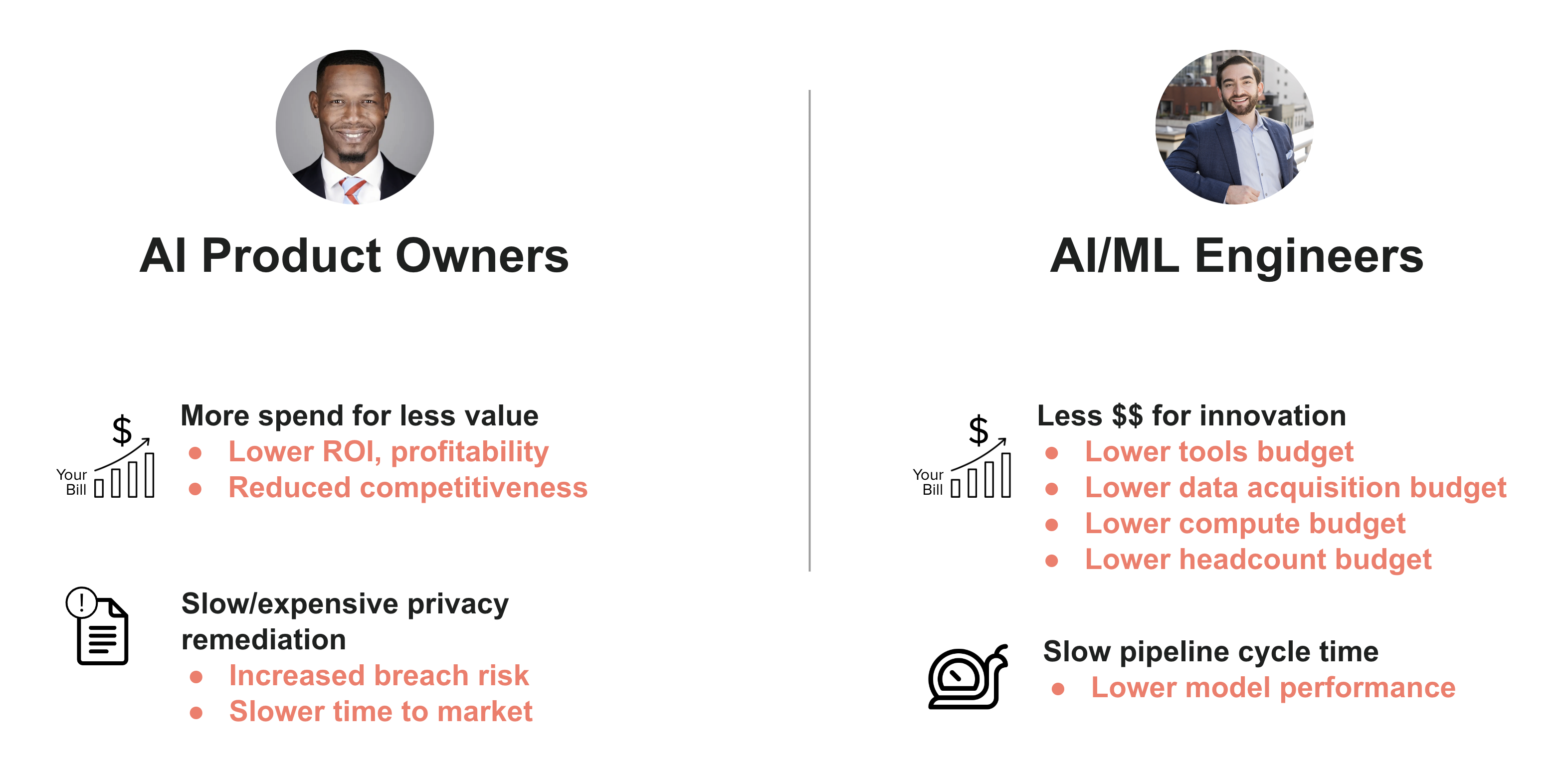

Taken together these data costs are consuming ever more of the AI innovation budget and crowding out investment in compute, tooling, and people. For AI product owners and AI/ML engineers the result is the same - higher costs and less effective outcomes. Simply put, the ROI on AI for financial services companies is lower than it needs to be.

How Granica helps

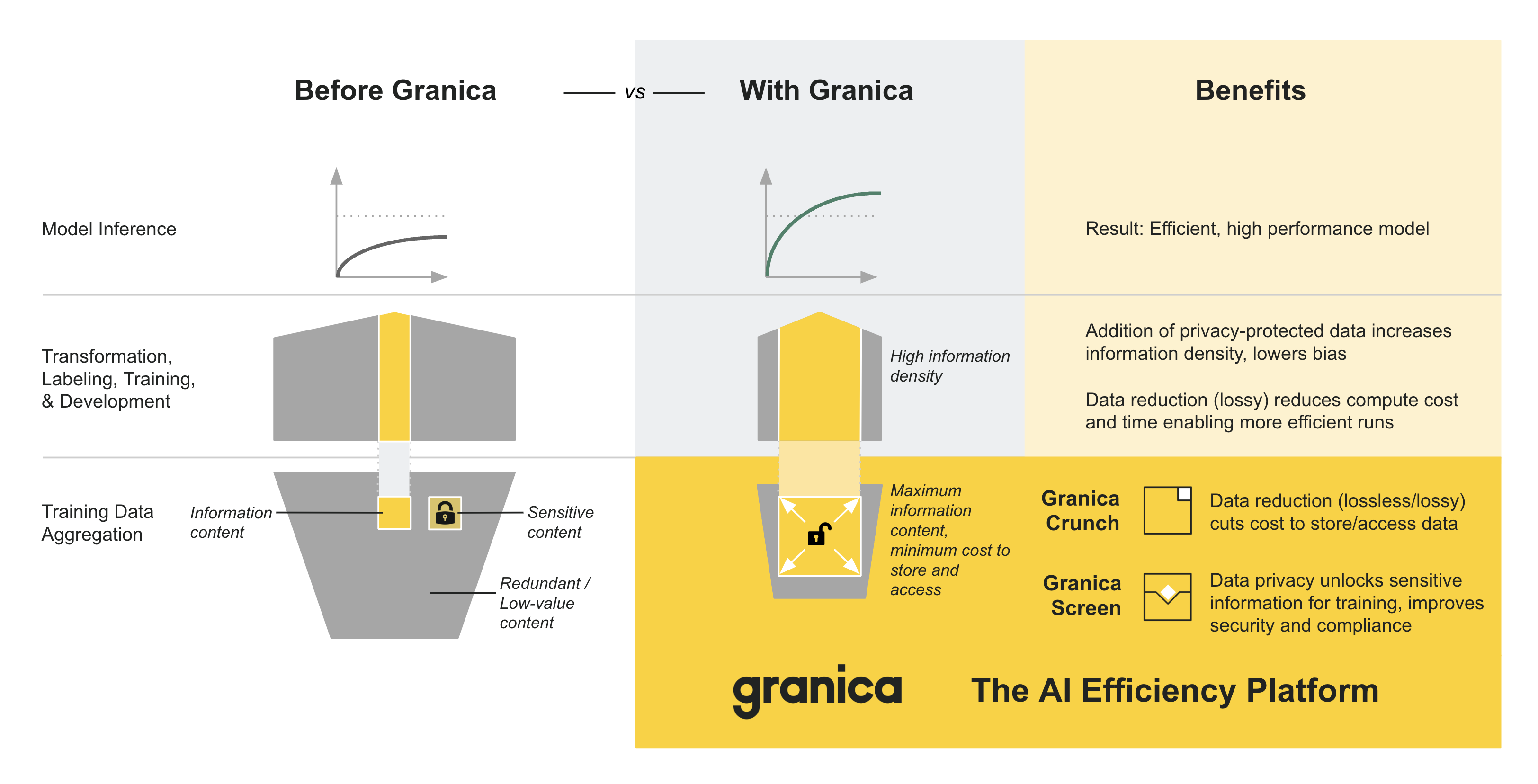

Granica is a new layer in the AI stack which increases the efficiency and utility of your AI-related data and thus your downstream AI pipeline stages, enabling you to free up significant money, resources, and time which you can reinvest to improve AI performance and outcomes. We achieve these efficiency gains via our products Granica Crunch and Granica Screen.

Granica Crunch: data reduction for financial services data

Granica Crunch reduces the storage cost associated with AI data without archival and/or deletion. Its advanced, patented machine learning-powered data reduction algorithms are specifically optimized for the clickstream and log data prevalent in the financial services industry.

How Crunch helps AI/ML Engineers

- Optimizes S3/GCS object storage costs, so you can allocate more resources to what matters most: data quality and model performance

- Supports a wide range of data types unique to the development of financial analytics and fraud systems, but we are open to further customization for your particular needs. Crunch also supports pre-compressed and archived formats

- Elastically scales up and down to support your dynamic workloads

- Is easily consumed as an API by your applications directly working with data in S3/GCS

How Crunch helps AI Product Owners and FP&A

- No upfont capital outlay eliminates the need to find or reallocate budget and thus accelerates your time to value. Crunch doesn’t cost budget, it frees up budget

- Ongoing, predictable savings enable you to accurately forecast and plan where and how to apply them

Data reduction eliminates redundant data

Crunch runs transparently in the background to losslessly reduce storage and access costs. The Crunch data reduction rate (DRR) varies by file type, and total savings also varies based on access patterns. The following table illustrates the typical DRR we have seen in production customer environments for financial services data:

| Type | e.g. files | DRR |

|---|---|---|

| Clickstream | .html, .json, etc. | >50% |

| Logs | .log, .json, etc. | >50% |

| Tables | .parquet | >50% |

DRR also varies based on the customer-specific data contained inside each file type. Estimate your savings to quickly evaluate the DRR for your specific data.

Granica Screen: privacy for financial services data

Granica Screen delivers high precision and high recall to accurately and comprehensively identify, protect, and monitor all sensitive information in structured, semi-structured and unstructured text data. It is built to enable privacy-enhanced computing.

How Screen helps AI/ML Engineers

- Enables you to use data containing sensitive information to safely build and train your AI models, unlocking greater model performance.

How Screen helps AI Product Owners and CISOs

- Improves your data security posture and mitigates breach risk

- Streamlines data security and privacy monitoring

- Strengthens your regulatory compliance